Long-Term Care is the Silent Wealth Assassin in Retirement

How to tackle the long-term care cost challenges

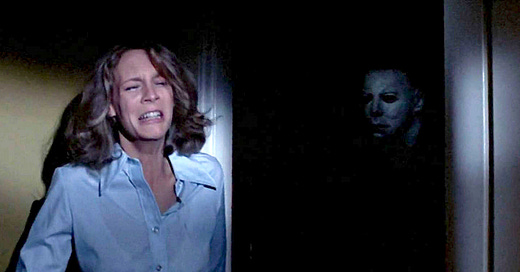

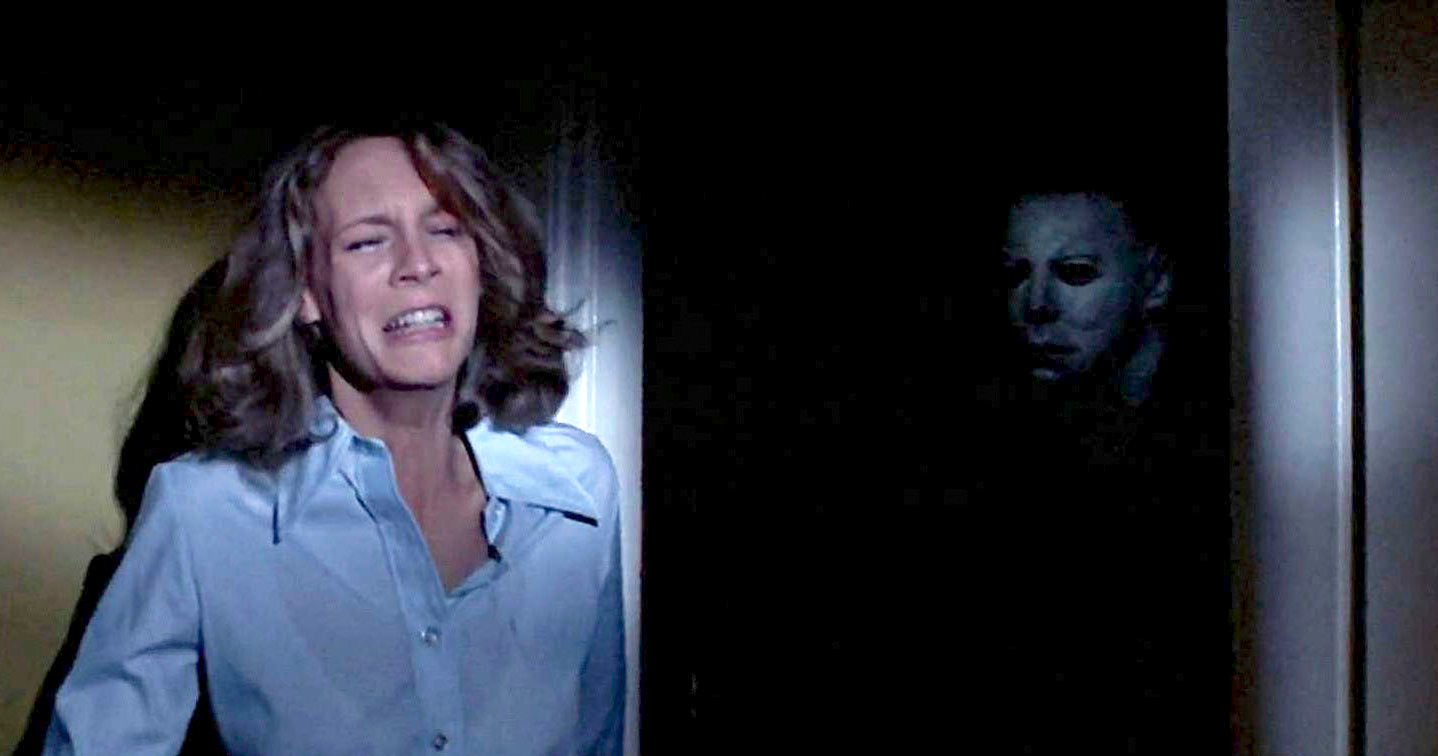

October is a month for re-watching old horror movies like Halloween, and not planning for long-term care (LTC) can be just as scary.

You think I may be overreacting, but the possibility of us Gen X'ers needing extended healthcare is very real and comes with a horrifying price tag.

For some, staying fit and active reduces the risk of LTC. But if life happens (as it does), the costs of supporting extended healthcare can be ghoulish.

Like most people, I procrastinate having difficult conversations and decisions about visualizing my lifestyle as dependent on others for help.

But you need a plan since LTC can be monstrously expensive and drain your assets faster than Dracula on a date.

Since we're all about confronting adversity, let's look at some aspects of LTC that we (as future Gen X retirees) need to evaluate in order to be prepared.

“It’s Halloween. Everyone’s entitled to one good scare.”—Sheriff Leigh Brackett in Halloween

Six degrees of separation - who can provide unpaid care?

Everyone thinks they need to save huge amounts of cash for healthcare, but you can cut costs by asking, “What healthcare resources are available to me for little or no cost?”

Spouses, children, or even close friends can help care for you in retirement. But there’s a problem… just because someone could be available to help doesn’t mean they are willing or able (the most important factor) to provide the type of care you might require.

Caregiving is no small task - some of us are caring for our parents right now and know this sobering fact. It's very difficult for a spouse who may be as old as you are or if you have adult children who may have their own families or careers to manage.

You may think that caring for yourself in your old age is the reason you got married or had kids, but the reality is that as you age, you are going to need professional help. If your medical conditions become more complex, asking family to help care for you may be beyond their expertise.

As you age, don’t assume family or friends will be your safety net. It’s important to have frank conversations with them now and then brainstorm backup options.

“Well, a boy's best friend is his mother.”—Norman Bates in Psycho

What kind of care would you be comfortable with?

Everyone has individual preferences for privacy and convenience. The same sensibilities apply to health care—what type of care are you willing to accept?

This may make you turn your head and go, "Hmmm?" You have to ask yourself if you are okay with a shared room in a nursing home or if you want a private room. Are you willing to live in an assisted living facility or prefer home health care? These personal preferences affect your healthcare costs.

Also, your area may not have the facilities or services you want. I live in a rural town in the NC foothills with a population of 18,000, and my options are more limited than if I lived in Charlotte, NC, which has nearly a million people. If we wanted to move to a world-class assisted living facility, then I’d probably need to move to that city.

However, if I wanted in-home health care I know of some options from several of my neighbors who have had hip or knee surgery.

The goal is to ensure you get the care you need and that it’s delivered in a way you’re comfortable with.

“Vanity is definitely my favorite sin.”—John Milton in The Devil’s Advocate

What expenses will long-term care replace?

My grandparents were in an assisted living facility, and I was shocked at some costs.

It's easy to get caught up in the minutia, but let’s zoom out and look at the whole picture. Some expenses you may have today may go away if you need to go into LTC.

Say you're living in a nursing home - you’re probably not paying a mortgage or utilities, and you're probably not traveling as much. So, if you've planned on a large travel budget for retirement, you can use that money to offset the cost of care. The key question you need to answer is: What is the incremental cost of long-term care besides the monthly expenses you’re already paying?

If you keep this in mind, you can understand the financial impact of LTC, and it will become easier to plan for the future.

“Groovy...”—Ash Williams in The Evil Dead

Medicaid may be a safety net, but it’s not a sure thing

There is Medicare, but there is also Medicaid for long-term costs.

For people with low income and limited resources, Medicaid is a joint federal and state program that helps cover medical costs.

Medicaid could potentially kick in to cover costs if an LTC event occurs and your assets are depleted. However, this does not happen automatically, and strict eligibility rules vary from state to state.

If you're considering Medicaid as part of your financial plan, you don't want to wait until you think you may need it—plan ahead if you think it's an option.

Applying for or receiving Medicaid is a complicated process, and if you feel that you may need it in the future, it may be a good idea to reach out to a Medicaid specialist who can educate you on that option.

“This is not a dream! This is really happening!”—Rosemary Woodhouse in Rosemary’s Baby

So, what are your options for funding long-term care?

Now that we’ve covered the “what-ifs,” let’s talk about how you’ll actually fund LTC. Here are the main sources that Gen X retirees should consider:

1. Personal financial assets

As Gen X reaches retirement, LTC will be paid for out-of-pocket. That means your portfolio needs to be built to generate income and withstand some unexpected events (like long-term health care).

Planning to utilize your retirement assets is crucial, but you don't want to give in to fear and spend as little as possible since you're worried about LTC costs. As long as you are aware that there is a possibility of an event and your portfolio can withstand some headwinds—you can move money around to cover any long-term costs.

2. Home equity

Everyone wants to age in place, but your home could be another resource for covering LTC costs. If you own your own home or have lived in it for a long time by the time you retire, you may have substantial home equity. This equity can be utilized as a contingency fund for future LTC needs.

Just remember that if you are married — you need to consider how dipping into this equity might affect a surviving spouse who wants to continue living in the home.

A couple of of ideas to tap this equity are reverse mortgages or even downsizing. But these options require some careful thought, especially regarding timing and the current state of the housing market.

3. Income annuities

Annuities are good options as you age, and we own several of them in our portfolio. Single-premium income annuities or qualified longevity annuity contracts can be an option for some Gen X retirees. These act as insurance for a surviving spouse and a guaranteed income stream.

Annuities can play a role in easing the financial impact if LTC costs deplete primary assets.

4. Long-term care insurance

You’d think that there should be insurance for long-term care—right?

Well, there’s a twist. Traditional LTC insurance has received some bad press in recent years.

The problem is that it’s often expensive, and many policies have benefit caps that might not cover the most severe medical scenarios. Despite the knocks it’s taken, the insurance market is evolving. Newer policies are emerging that could be worth investigating. Hybrid products combine LTC benefits with life insurance or annuities, which may provide more flexibility.

Unfortunately, traditional LTC insurance still plays a relatively small role in covering care costs in the U.S.

Closing thoughts

Long-term care planning is about making sure that you have financial stability without sacrificing your quality of life.

With the four options we discussed—family support, financial assets, home equity, and insurance products—you can begin to formulate a plan for your future.

Most people don’t see every angle when they are planning for retirement, and the need for long-term care usually comes up fast and before you least expect it.

Being ahead of the curve will reduce the eventual anxiety that retirement may bring.

Having one part of retirement under control can help you focus on the other facets that may need more attention.

Hasta la vista!

@Chris, Where can I research or at least stay current on LTC insurance options?

My husband has been researching LTC options in Thailand. He’s instructed me to ship him there when if the time comes. It’s definitely an option and much more affordable.