1999 Called and Wants You to Make These 15 Money Mindset Shifts Now

Some retirement help even if you partied it all away for the last 25 years

It’s a lazy Sunday, and retirement might seem a way off.

But the clock’s ticking.

You don’t want to be scrambling at 65 and wondering if you can afford to stop working.

You need to prioritize and make a plan to save, but your spending habits are deeply ingrained. Your mindset needs to shift to savings and away from spending.

But how do you recalibrate your mind after all these years?

Here are 15 tips to help you reboot your thinking about retirement savings.

1. Think of retirement as an absolute goal

Stop treating retirement savings like an afterthought. It’s not a “nice to have”—it’s a must. Shift your thinking to view retirement savings as just as important as paying your mortgage or putting food on the table. It’s like having a child you must put through college—you allocate funds for their future education even though they’ll drop out and become a mechanic.

2. Picture your future self

Visualize your retirement life—where you want to live, how you want to spend your days, and the lifestyle you want to maintain. Connecting with your future self will motivate you to save for the freedom to enjoy those years. You’ll be amazed that your vision of your future will differ from what actually occurs since life always throws you curveballs.

You are my fire

The one I desire

Believe when I say

I want it that way

The Backstreet Boys, lyrics from “I Want It That Way”

3. Stop thinking it’s too late

It’s easy to think, “I’ve already missed the boat,” especially if you’ve been lax with savings. But it’s never too late to start. Focus on what you can do now, not what you haven’t done. Small, consistent efforts today can still lead to significant progress. Very few people start saving for retirement in their twenties, so you’re not late to the party.

4. View savings as freedom, not sacrifice

It’s common to see saving money as restricting or missing out, but flip the script. Every dollar you save is actually buying you future freedom—freedom from stress, financial limitations, and the freedom to enjoy your life on your terms. People want the freedom to spend time doing what they want, and money buys them that freedom.

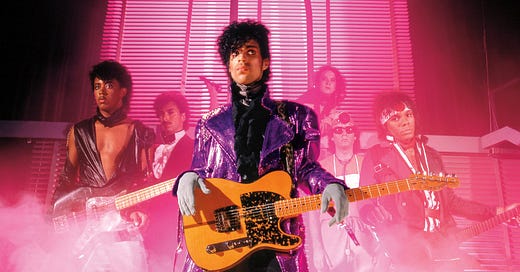

Say, say, 2000-00, party over

Oops, out of time

So tonight I'm gonna party like it's 1999

Prince, lyrics from “1999”

5. Shift from “spend now” to “save now”

Instead of spending what’s left after your bills and expenses, flip the process. Pay yourself first. Treat your retirement savings as the first bill you pay each month, and then live off what’s left. Prioritize your future before today’s expenses. Direct deposit is great to automate this process. If you have a 401(k) plan, the savings are taken out pre-tax.

6. Focus on progress, not perfection

Perfectionism can lead to paralysis. You don’t need to go from saving zero to saving 20% of your income overnight. Start small and build up. Progress matters and each increase in savings gets you closer to your goal. Start by saving something and step it up 1% or more per year. Most corporate retirement plans will allow you to do this.

Somebody once asked could I spare some change for gas

I need to get myself away from this place

I said yep, what a concept

I could use a little fuel myself

And we could all use a little change

Smash Mouth, lyrics from “All Star”

7. Understand the power of compound interest

Realize that time is your best friend when it comes to retirement savings. The money you put away now grows exponentially thanks to compound interest. Even small contributions today can grow into something significant down the line. Remember the rule of 72 when investing—72 divided by your interest rate equals how long it takes to double your money.

8. Reframe savings as an investment in your happiness

Saving for retirement isn’t about depriving yourself now—it’s about investing in your long-term happiness and security. Think of each contribution as allowing your future self to live comfortably without financial worries. You can still invest a ton and not be entirely happy in retirement—but that’s another problem.

9. Stop waiting for “mo money, mo money, mo money”

Many people think they’ll start saving seriously when they earn more, but that day often doesn’t come. Instead of waiting, start with what you have now—compound interest is your friend, so there is a cost to wait to save. As your income grows, your savings will too—if you make it a priority today.

10. Think long-term, not just short-term

Our brains are wired for instant gratification, but shift your focus from the next few years to the next few decades. Stop and ask yourself—will this purchase or expense matter in 20 years? Thinking long-term helps you prioritize retirement savings over those Amazon Prime Day deals. People have looked at their impulse buys and regretted not saving for retirement.

Now you've been maxing out my card (card)

Gave me bad credit, buyin' me gifts with my own ends

Haven't paid the first bill

But you're steady headin' to the mall

Goin' on shopping sprees

Perpetrating to your friends like you be ballin'

Destiny’s Child, lyrics from “Bills, Bills, Bills”

11. Redefine your version of success

If success in your mind is tied to a bigger house, nicer car, or material wealth—it’s time to sit down and redefine what success means. True financial success is having the freedom to retire comfortably, enjoy life without debt, and never worrying about outliving your savings. Sometimes you need to flip the script and define what success is to you and your future retirement self.

12. Let go of the "keeping up with the Joneses"

Stop comparing your financial life to others. The Joneses might look great now, but they might not have anything saved for the future. Focus on your financial goals and ignore what others spend their money on. Let the Joneses dig their financial hole—just avoid digging one yourself.

Okay, so you've got a car

That don't impress me much

So you got the moves but have you got the touch

Don't get me wrong, yeah I think you're alright

But that won't keep me warm in the middle of the night

Shania Twain, lyrics from “That Don’t Impress Me Much”

13. Celebrate milestones, not just the final goal

Retirement can feel so far off that it’s hard to stay motivated. Break the journey down into smaller milestones. Celebrate hitting your first $1,000 saved, then $10,000, and so on. Recognizing these small wins will keep you motivated for the long haul. Unsure of what financial mile markers to celebrate? Here’s a small list.

14. Turn anxiety into action

It’s normal to feel anxious if you’ve fallen behind on savings, but don’t let that anxiety paralyze you. Instead, use it as fuel to take action. The sooner you start making changes, you’ll feel more in control of your financial future. Still feeling nervous? Here are some practical steps to overcome retirement saving anxiety.

15. Surround yourself with positive financial influences

Those around you influence your mindset. If your social circle prioritizes spending over saving, it might be time to find a new circle. Surround yourself with people who value financial security and prioritize saving for the future. That mindset will naturally rub off on you. Heck, you have a chat group in this newsletter and have friends on the same journey as you.

Freedom is a beautiful thing, peace out!

Great tips, Chris. Re keeping up with the Jones's, do we even like them? Being of nearly retirement age, and also very wise ;-), I've noticed over the years that the Jones' tend to have large mortgages, a lot of debt and waste their money on depreciating assets like gas guzzling status cars. When redundancy or divorce hit, they are not well placed to survive financially.